The minimal payment level is generally lower than the passion just payment. The choice to make a minimal settlement is normally offered only for the initial numerous years of the finance. To lower the threat, several mortgage producers offer many of their home loans, especially the mortgages with taken care of prices. If you are thinking about an ARM, you need to run the numbers to establish the worst-case situation. If you can still manage it if the home loan resets to the maximum cap in the future, an ARM will save you money each month. Ideally, you should make use of the cost savings compared to a fixed-rate home loan to make extra principal settlements each month, to ensure that the total financing is smaller sized when the reset occurs, additionally reducing costs.

- They are, nevertheless, transforming much more to variable-rate mortgages, which supply reduced prices.

- With this option, you pay just the interest for a specified time, after which you start paying both major as well as passion.

- Your home loan reset date can take place monthly, quarterly, yearly, every three years, or every five years, relying on the kind of financing you obtain.

- After that the interest rate readjusts every 6 months for the remaining twenty years.

- The difference of time between the fixed rate as well as adjustable price durations are usually revealed over one another.

Our details is readily available free of charge, nevertheless the services that appear on this site are given by business that may pay us an advertising cost when you click or join. These firms might affect just how as well as where the solutions appear on the web page, but do not influence our editorial decisions, referrals, or suggestions. ARMs obtained a shiner in the realty market collision of 2007, yet the swelling has actually decreased enough that they stand for 14% of the dollar volume on mortgage applications in 2018. These complexities can position dangers for consumers who don't fully comprehend what they're getting involved in. This might influence which products we review and also write about, yet it in no other way affects our recommendations or suggestions, which are grounded in countless hours of research study. Our partners can not pay us to guarantee desirable reviews of their services or products.

Study Your Alternatives

The benefit for the consumer is that the monthly settlement is guaranteed never ever to be enhanced, and also the lifetime of the finance is also taken care of beforehand. The disadvantage is that this version, in which you need to begin paying a number of years prior to actually obtaining the finance, is primarily aimed at once-in-a-lifetime home customers who are able to intend in advance for a long period of time. That has become a trouble with the normally greater flexibility that is required of workers nowadays. In contrast, fixed price home mortgages created 15, 20, or 30 years have a set quantity of passion on the funding that does not change.

Obtain An Extra Budget Friendly Rate Of Interest As Well As Lower Month-to-month Repayments At The Beginning Of Your Home Loan

Thankfully, making the effort to comprehend just how ARMs work can assist you be prepared in situation your price goes up. Some big products may not be readily available to first time home buyers. Find The Responses You Required See our Learning Center, where we damage down the home mortgage process so it's less complicated to comprehend.

At the beginning of your term, mostly all of your home loan payment will certainly go toward paying passion. As the years pass, this turns to make sure that by the end of the term, the large majority of the payment is towards the principal. But you can also place extra money toward the major on a monthly basis if you aren't based on any type of prepayment penalties your loan provider could bill. We'll get into the advantages of paying down principal in a 2nd; embracing this technique could be valuable for those who intend More help ahead. In this write-up, we'll be going over the 5/1 ARM, which is a flexible price mortgage with a rate that's initially dealt with at a price less than similar fixed-rate home mortgages timeshare buyout for the initial 5 years of your finance term. The flexibility you can construct right into your budget with the preliminary reduced monthly repayments provided by an ARM offers you the opportunity to develop your cost savings as well as pursue other monetary goals.

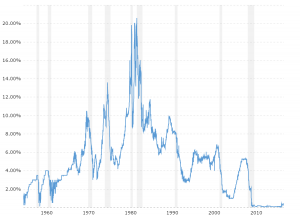

Because of the intrinsic rate of interest risk, lasting fixed rates will tend to be higher than temporary prices (which are the basis for variable-rate loans as well as mortgages). The distinction in rate of interest between brief and long-term loans is called the yield contour, which usually slopes up. The opposite circumstance is called an inverted yield contour and is reasonably seldom. ARMs call https://diigo.com/0ouoc3 for borrowers to prepare for when the interest rate starts altering and also monthly repayments may grow. Despite having cautious planning, though, you might be incapable to sell or re-finance when you want to.

ARMs can be valuable for property buyers who don't plan on remaining in their home for more than a handful of years, noted Rugg of loanDepot. Much of those with ARMs in the last couple of years actually saw their rates go down to much less than their beginning prices when they started adjusting. The various other means to protect that 3.33 rate of interest is to pick a 5/1 ARM mortgage.

Choices of consumers might additionally be affected by the guidance that they obtain, and a lot of the suggestions is provided by loan providers that may favor ARMs because of economic market frameworks. Taking on a variable-rate mortgage does not have to be a risky venture, as long as you comprehend what happens when your home loan rate of interest resets. Unlike set home mortgages where you pay the very same interest rate over the life of the loan, with an ARM, the rate of interest will certainly transform after a time period, as well as in some cases, it may rise significantly. Understanding beforehand just how much more you'll owe-- or may owe-- each month can stop sticker shock. More important, it can assist guarantee that you have the ability to make your home loan settlement every month. Because of the initial low rates of interest, it can be attractive to customers, specifically those who do not plan to stay in their houses for also lengthy or who are experienced enough to re-finance if rate of interest rise.